22. Februar 2024

Revitalize Your Finance in Good Times: Unlocking Financial Resilience

Marta Dudka, Senior Research Associate, and Prof. Dr. Stefan Hunziker, Professor of Risk Management, Institute of Financial Services Zug IFZ

The Lucerne University of Applied Sciences and Arts and the University of Applied Sciences Kiel conducted a comprehensive analysis of the crisis susceptibility and resilience exhibited by the 505 largest companies in the DACH region over five years from 2018 to 2022.

- What insights for financial practitioners can we draw from the research?

- How well-prepared was the region for a white swan event?

- Did the region exhibit differentiation in financial resilience among its corporate giants?

The findings of the research, meticulously compiled and presented in the Enterprise Risk Management (ERM) Report 2023, offer a nuanced perspective on the region’s economic landscape. A condensed summary can be found within this article.

Analyzing the Financial Landscape

The study encompassed an in-depth analysis of the 230 largest companies in Germany, the 70 largest companies in Austria, and the 205 largest companies in Switzerland, based on their market capitalization 2022. The DACH region contributes nearly 6 billion euros to the gross domestic product, comprising roughly one-third of the total GDP of all EU-27 states. The study aimed to understand companies› financial resilience or susceptibility in this region. The results can serve as a basis for developing more effective risk management strategies and thus contribute to the stability and sustainability of the economy throughout the entire DACH region.

The methodological basis of the ERM Report 2023 is the study published by the Deutsche Bundesbank in 2014 on the crisis susceptibility of German companies in the context of the financial and economic crisis of 2007/2008. Since then, no major study has been conducted. Similar to the study by the Deutsche Bundesbank, the analysis of ERM report 2023 considers variables from three different risk categories, namely market demand risk, financial risk, and performance economy risk, as influencing factors on financial crisis resilience or susceptibility.

Unveiling Key Insights

Companies need to reassess and elevate the significance of their finance department. Controlling, cost accounting, liquidity, and equity management are essential components for strengthening financial resilience. Companies should learn from the crisis that increasing financial resilience is a survival-relevant goal, even if there is little incentive to invest in this regard in good times. Companies can refine their risk management frameworks by identifying the determinants influencing their susceptibility to crises and their ability to navigate through them. Consequently, Enterprise Risk Management assumes a pivotal role in the timely detection and prevention of crises, encompassing the identification, evaluation, and mitigation of all inherent risks a company faces. In traditional risk management, individual risks are considered in isolation, largely neglecting the interactions between them (silo thinking). However, Enterprise ERM constitutes a holistic, integrated approach.

Within the scope of companies analyzed, those in a precarious situation before the crisis are experiencing heightened impacts and anticipate further challenges ahead. Specifically, businesses with diminished equity, poor liquidity, inflexible cost structures, and low-profit margins bore the brunt of the COVID-19 crisis. These enterprises frequently resort to job cuts and investment reductions, particularly in anticipation of a medium-term crisis duration. The COVID-19 pandemic starkly exposed deficiencies in the resilience of many companies.

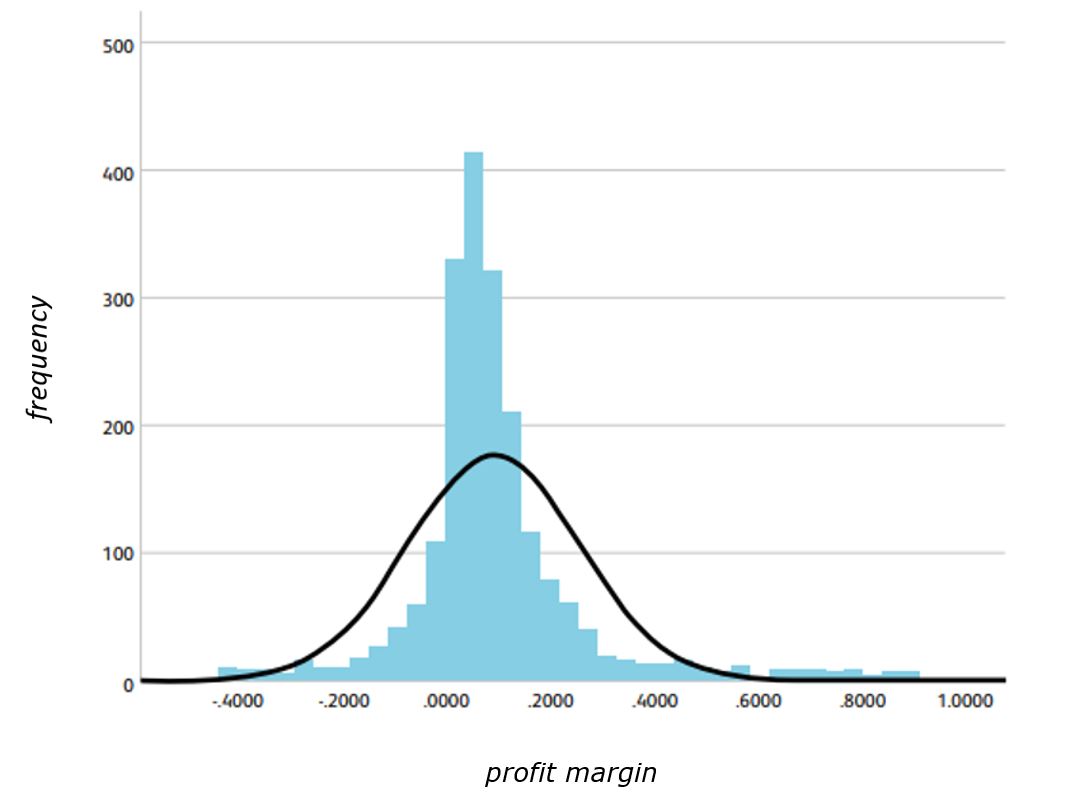

Let’s delve into the specific numbers. The profit margin of most companies examined is positive and averages 9.24%. The majority of DACH companies achieved a positive profit margin during the study period. Only 315 companies (15.4%) had a negative profit margin. They were not prepared for that white swan event. 1% of companies achieved a profit margin of 75.6% or more.

Compared to the Deutsche Bundesbank study, it is noticeable that the values for crisis-prone companies in our analysis are significantly more negative. It can be understood as an indicator of the more substantial effects of the Corona crisis on the profitability of companies compared to the financial and economic crisis. However, the chi-square test did not reveal a statistically significant relationship between the years and the number of companies in the respective groups. Only for 2020 can a statistically significant overrepresentation of crisis-prone companies be observed. In addition, the proportion of crisis-prone companies increased again in 2022. This observation may already be an initial indicator of further crisis developments caused by the Ukraine war, such as the sharp rise in inflation in general and energy and food prices in particular, as well as the rise in interest rates induced by inflation. It is, therefore, essential to observe how the proportion of crisis-prone companies develops in 2023. Interestingly, the number of crisis-resilient companies remains stable throughout the observation period and during the Corona crisis.

Since the various countries have taken economic policy measures to support their companies during the Corona crisis to varying degrees, the influence of the respective country on the assignment to the two crisis-resilient and crisis-prone groups was also examined.

| Country | VaR 95% (crisis-prone) | VaR 5% (crisis-resilient) |

| Germany | 54 or 5% | 39 or 3.7% |

| Austria | 7 or 3.5% | 9 or 4.5% |

| Switzerland | 41 or 5.3% | 55 or 7.1% |

Detailed analysis for Switzerland

In Switzerland, numerous industries were affected by the pandemic, either directly or indirectly through their value chains. A study from the Bern University of Applied Sciences highlights that many businesses faced significant supply chain challenges during the COVID-19 crisis, leading to raw materials and materials shortages. Moreover, constraints on cross-border traffic and a shortage of labor in production exacerbated issues. These constraints were due to workers being part of risk groups and compliance with hygiene regulations, hindering smooth operations. Additionally, reduced government work led to delays in issuing necessary permits, exacerbating the challenging situation and declining demand for products and services across various industries.

Industries like manufacturing, healthcare, and information technology were among the most affected, with companies experiencing revenue declines and increased costs due to disruptions and extraordinary expenses to comply with hygiene regulations. Remarkably, Real Estate sector firms dominate the crisis-resilient group, reflecting resilience despite ongoing market shifts post-pandemic. Most of these companies remain in the crisis-resilient group even in 2022, with explanations ranging from inflation-driven interest rate hikes to early market rebounds.

However, compared to analyzed companies from Germany and Austria, Swiss companies are overrepresented among crisis-resilient companies. The overall profit margin in Switzerland is higher. This can be attributed significantly to the high agility of both the economy and politics during the pandemic, with a faster transition to remote work and digital sales channels compared to other countries. Further indicators include Swiss companies› above-average equity capitalization and low expense ratios. In both areas, resilient Swiss companies perform significantly better.

The Organisation for Economic Cooperation and Development (OECD), based on its analysis of Switzerland’s handling of the pandemic, gives Switzerland a good report card. ‹The Swiss economy has once again proven to be very resilient in a global crisis,› noted OECD Secretary-General Mathias Cormann. The OECD sees the strong diversification of the economy as a central reason for its resilience, with the hospitality and entertainment industries not playing a dominant role in the overall context.

Key Tenets for Practitioners

Strengthening Financial Resilience: The empirical analysis highlights that companies prone to enduring crises are often situated in industries with inflexible cost structures and low-profit margins. The COVID-19 crisis underscores companies› need to identify and potentially reduce bottleneck areas in their business models, which can lead to significant drops in earnings, liquidity, and increased costs during external crisis events. Companies with robust financial resilience, particularly in terms of strong equity and adequate cash availability, demonstrate the ability to overcome challenges during crises. However, achieving financial resilience requires detailed liquidity forecasts and emergency plans tailored to different crisis scenarios.

Enhancing Organizational Resilience for Crisis Preparedness: Organizational resilience supports maintaining business models during crises, particularly in industries affected by lockdowns and disruptions to traditional sales channels. Critical areas of business models should be identified through scenario and dependency analyses, with appropriate buffers established to strengthen organizational resilience. Operational buffers such as additional inventory, personnel flexibility through flexible contracts, and network buffers through external collaborations are essential to organizational resilience.

Momentum for Strengthening Financial Processes: Financial processes become increasingly relevant during crises, emphasizing the importance of optimizing cost structures with timely and reliable financial data. Effective financial departments should be established proactively during favorable times to respond efficiently to financial challenges during crises.

Momentum for Optimized Risk Management: External crises highlight the importance of risk management in enhancing financial and organizational resilience. Risk management strategies should focus on identifying critical areas of business models across the entire supply chain, defining early warning indicators, and developing emergency plans. Comprehensive stress testing and an increased focus on risk dependencies throughout the value chain are essential for effective risk management.

Integrating Risk Management with Strategic Planning: Strategic resilience development requires a holistic view of risks, opportunities, threats, and possibilities. Integrating risk management into strategic planning allows companies to incorporate risks and opportunities into decision-making processes and business model development. Flexibility and adaptability are crucial in adjusting strategies to changing circumstances and fostering a culture of resilience and innovation within organizations.

Strengthening Cooperation among Risk Management, Controlling, and Finance: Effective cooperation among financial functions enhances response speed and crisis adaptation. Integrating scenarios and stress tests into financial and liquidity planning requires lean and flexible processes and a cooperative culture that promotes transparency and information exchange among financial departments.

In Conclusion

As organizations navigate the labyrinth of uncertainty, proactive enterprise risk management and resilience emerge as indispensable competencies for long-term viability. By embracing innovation, collaboration among financial functions, and forward-thinking risk management practices, companies can emerge more robust, and more resilient in an ever-evolving landscape. As the pace of business accelerates, so does the rate of risk. In this rapidly evolving landscape, procrastination is not an option. Act now to boost your financial resilience!

This might also be of interest to you:

- CAS Governance, Risk and Compliance

- CAS Financial Management

- CAS Controlling

- Book “Enterprise Risk Management – Modern Approaches to Balancing Risk and Reward” by Prof. Dr. Stefan Hunziker

Kommentare

0 Kommentare

Danke für Ihren Kommentar, wir prüfen dies gerne.