16. Mai 2024

Swiss independent Wealth Managers favor Swiss and US equities

How do Swiss independent wealth managers (WMs) allocate their assets? Do they prefer direct investments or actively/passively managed funds? And what is their take on sustainable investing? 161 WMs answered these questions in our latest «VSV-ASG Investment Pulse». We shed light on some of the results in this blog. The full report can be downloaded here.

Autoren: Manfred Stüttgen, Tatiana Agnesens

In 2024 equities as well as bonds have been thriving in WMs portfolios. Direct investments are becoming ever more popular across asset classes. And WMs continue to have mixed views on sustainable investing – unless their clients ask for it. An interesting picture emerges when looking at WMs current investment behavior.

Swiss and US equities in favor. Bonds gain further ground.

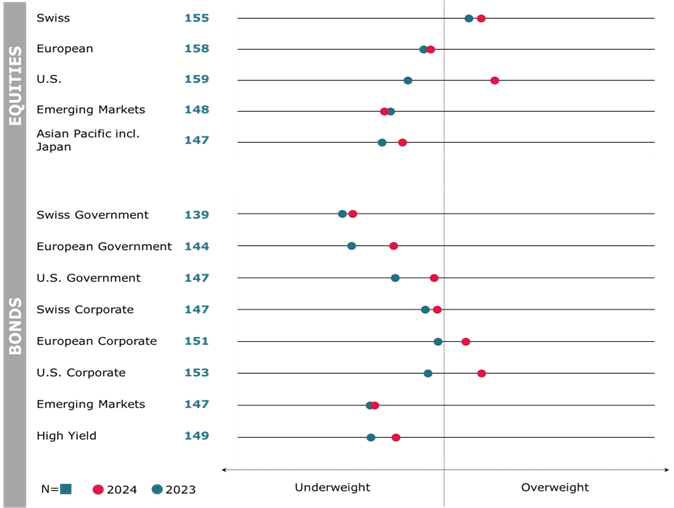

Last year Swiss independent wealth managers (WMs) navigated a difficult investment climate marked by global economic uncertainties and the dominance of key technology stocks. Taking these challenges into account, they rapidly adjusted their strategies, resulting in flourishing equity and bond holdings by 2024. Previously, in 2023, WMs favored Swiss equities only. In 2024, their preference not only remains strong for Swiss stocks but also expands to include an overweight position in US equities, as well as European and US corporate bonds. The overall trend of increasing bond allocations that began in 2023 persists into 2024.

Direct investments are becoming more popular.

WMs are choosing to invest directly in Swiss equities as well as government and corporate bonds. On the other hand, a strong preference for using funds is observed for emerging markets and Asia Pacific equities as well as for emerging market bonds and high yield bonds. Notably in 2024, there has been a slight shift in preference towards direct investments, particularly in the fixed income sector.

Preference for passive strategies increases, whereby ETFs are favored over index funds.

Overall, WMs choose a balanced approach between active and passive investment strategies for equities and bonds, though they show a strong preference for passive strategies in emerging market and Asia Pacific equities. Nevertheless, in 2024 there has been a distinct shift towards passive strategies in all equity and bond markets, except for government bonds. For their passive investments WMs consistently favor ETFs over index funds in both asset classes. However, while ETFs have seen a significant increase in popularity for equities, index funds have also been gaining traction in the bond sector.

Mixed views on sustainable investing continue to prevail.

Only 20% of WMs incorporate sustainability criteria into their investment processes as a standard practice, while 32% do not include them at all. At the same time, 48% of WMs include ESG criteria at the request of their clients, showing that sustainability inclusion is often client-driven but seldom a standard. Larger WMs are more inclined to integrate standard sustainability criteria compared to smaller WMs. With a closer look at the ESG strategies applied, those WMs who incorporate sustainability criteria into their investment processes (either by default or on client request) are increasingly favoring ESG integration and negative screening. Best-in-class-selection as well as sustainability thematic investments are also often used, while impact investing, climate strategies as well as ESG engagement & voting are rarely applied.

Conclusion

The insights, derived from our most recent survey on WMs’ investment behavior, reflect the dynamic nature of the Swiss wealth management industry: In 2024 equities as well as bonds have gained weight in WMs’ portfolios and direct investments are much more frequently used than in the year before. For those WMs using funds or ETFs, this year’s findings reveal a strong trend towards passive investment strategies, particularly favoring ETFs over index funds. Additionally, the survey highlights ongoing mixed views on sustainable investing. WMs seem to be pragmatic regarding ESG inclusion in their portfolios: if clients ask for sustainable portfolios, the majority will cater to that need; only 20% of WMs would include ESG strategies by default, though.

For more information on the VSV-ASG Investment Pulse 2024, a webinar on demand is available here.

Kommentare

0 Kommentare

Danke für Ihren Kommentar, wir prüfen dies gerne.