4. Juli 2022

Only a few independent wealth managers in Switzerland are ESG pioneers

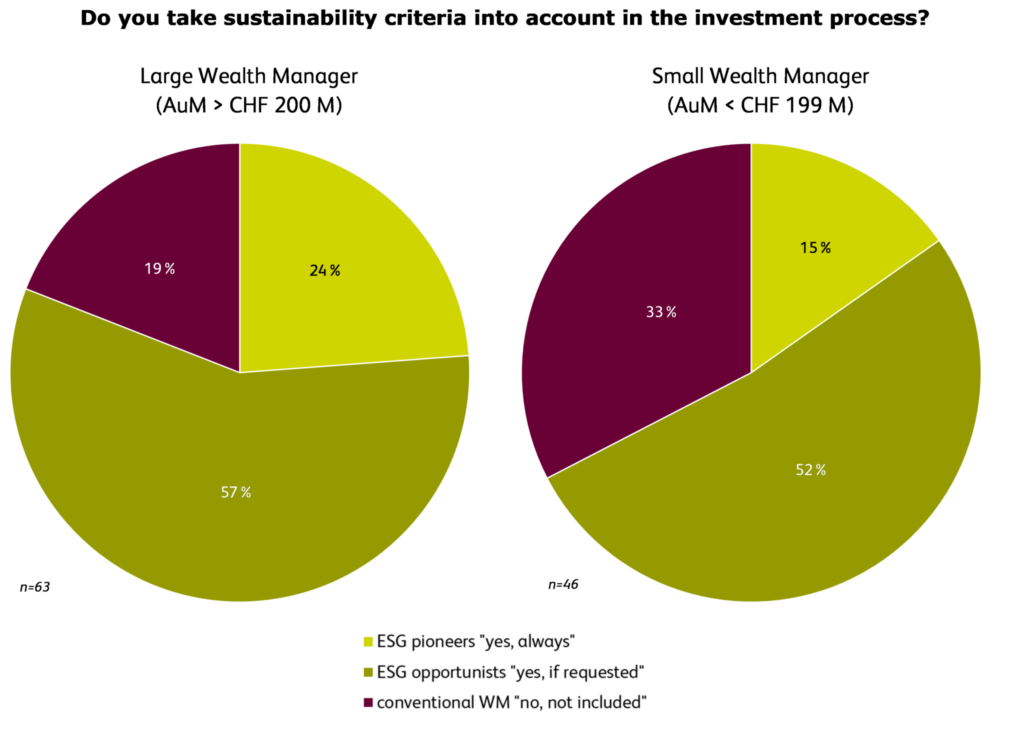

In a recent study, we asked Swiss independent wealth managers about their attitude towards sustainable investments. Surprisingly, survey results indicate that one in two wealth managers includes sustainable investment criteria only on client request, and one in four does not include them at all. The full report can be downloaded here. (1)

Authors: Manfred Stüttgen, Nadine Berchtold

Barriers to ESG implementation are still perceived to be high

As the three most significant barriers to implementation, independent wealth managers mentioned the lack of data and standards, an unsatisfactory risk-return profile of ESG investments, and a lack of in-house expertise and resources. Understandably, these barriers are perceived to be high. Independent wealth managers often position themselves as experts in optimizing risk and return of clients’ portfolios. The detailed sustainability assessment of individual securities is usually not part of that ambition. To build up the required sustainability knowledge in-house would be demanding and resource intense. Also, ESG data is required which must be individually collected or externally purchased, e.g., from ESG-rating agencies. This is a question of a sufficient number of personnel and financial resources. In times where Swiss wealth managers are busy implementing new regulatory standards, this can easily turn out as a bottleneck.

Differences between small and large wealth managers

However, large, and small wealth managers differ significantly in their attitudes toward the integration of ESG criteria into the investment process (figure 1). Only 15 percent of the small wealth managers do always include ESG criteria, compared to 24 percent of the larger wealth managers. Larger wealth managers typically have more resources at their disposal and are more likely to invest in the required internal or external ESG analyses.

Conclusion

Currently, large wealth managers are more likely to include sustainability criteria in the investment process. For a substantial share of Swiss wealth managers, the barriers to including sustainability criteria are perceived to be still very high. The main barriers – according to our survey – are the lack of data and standards, an unsatisfactory risk-return profile of ESG investments, and a lack of in-house expertise and resources of independent wealth managers.

(1) The study “VSV Investment Pulse” was carried out in cooperation with Vanguard and the Swiss Association of Asset Managers VSV-ASG as a facilitator.

Kommentare

0 Kommentare

Danke für Ihren Kommentar, wir prüfen dies gerne.